step 3. Be cautious about Beginning The newest Profile

dos. Maintain your Balance Reduced

Extent you owe and additionally performs a majority inside the determining your credit score. The latest faster you borrowed, especially in comparison toward amount you could potentially use, the greater your own score. Even although you possess a high limitation in your bank card, keep equilibrium really lower than they. It’s better to pay-off the money you owe after you cannot acquire as well much. Additionally you look credible so you’re able to lenders in the event the balance stand reasonable.

Although you have to have borrowing from the bank accounts to ascertain a credit background and commence building your rating, you’ll have an excessive amount of a very important thing. The fresh borrowing affects their get, and every go out your discover a separate account, their get falls a little while. For folks who big date into the shopping center and you may unlock multiple new store playing cards in one day, that can enjoys a significant influence on your own credit. Opening multiple this new credit cards at once is a red-colored banner for a lender. They might look at the this new account and you can ask yourself when you’re experiencing financial difficulties, which would succeed challenging about how to pay a different sort of financing.

When you find yourself undergoing trying to get a mortgage, its vital you end beginning the latest levels, at the very least if you do not has finally recognition into the mortgage and keeps finalized in your domestic. Beginning a new credit card or taking right out a car loan if you’re their home loan is in the underwriting procedure is seem like an alert bell for the bank, leading them to press pause into the procedures.

4. Require Borrowing limit Grows

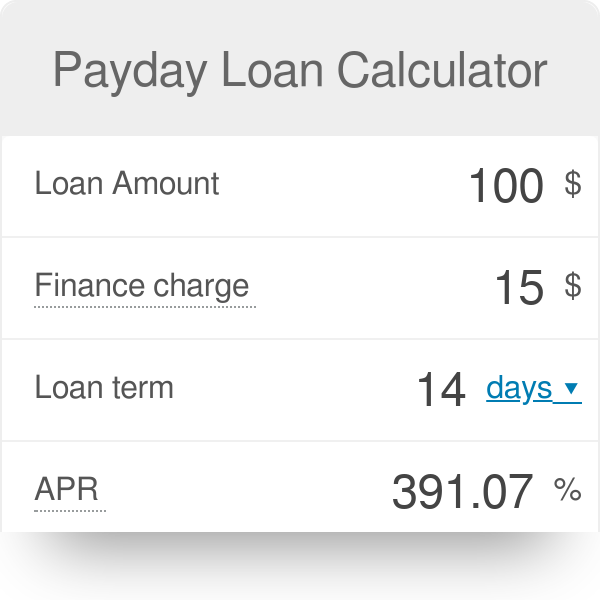

Your borrowing from the bank application ratio impacts your credit rating. The ratio compares how much cash borrowing from the bank you have available versus. how much you have got made use of. Particularly, for those who have credit cards which have an effective $step one,000 restrict and you can a balance out-of $100, your credit application ratio are 10%. The low brand new ratio, the higher to suit your borrowing from the bank. Maintaining your stability lowest is a sure way to keep your proportion lower. One other way is to try to enhance your borrowing limit. Including, you might ask the credit card company to boost the $step one,000 restriction so you can $dos,000.

Credit card issuers is ready to improve limit inside the several instances. When you yourself have a reputation expenses punctually, the business you’ll view you once the a lower life expectancy-exposure debtor and you can agree to improve restriction. An upgrade in your credit rating otherwise an increase in the home earnings may also encourage credit cards providers that you are an excellent candidate to own a threshold increase.

5. Remain Membership Discover

Brand new prolonged your credit score was, the greater it appears to be in order to loan providers. You aren’t a beneficial 20-season records keeps more to display than individuals which have a five-12 months background. Preferably, keep borrowing membership offered to maximize along their record. Such as, if you have a charge card that you no longer fool around with, it’s still a smart idea to hold the account discover.

One more reason to save credit card accounts unlock is the fact performing thus assists your credit use ratio. For those who have about three playing cards that each and every possess a beneficial $5,000 restrict, your own readily available borrowing try $fifteen,000. Intimate one of those cards, and your available credit drops to help you $10,000.

6. Keep on top of Their Borrowing from the bank

Men and women tends to make problems, like the credit agencies. If you intend on trying to get home financing in the future or perhaps in new distant upcoming, it’s a good idea to keep an almost vision on your own credit history, to locate and you can boost one problems that come up. Possible problems were incorrectly said costs, accounts that don’t belong significant link to both you and dated information. Once you see a blunder on your own statement, you can allow borrowing bureau see, and it will get it done to fix it.

No Comments