Ways to get Security Out of your home As opposed to Refinancing

You could potentially cash out house collateral rather than an effective refinance

If you need a massive sum of money and you’re wanting to know getting security from your own home versus refinancing, there are choices worth considering.

You can tap their guarantee courtesy several strategies, along with family equity funds, house equity lines of credit, and you may house collateral assets, to name a few. Even if a money-aside re-finance get lure your, it is far from the only method to use your household collateral.

What exactly is family security?

In other words, family guarantee is short for the portion of your house you it is own. Your home equity was determined as the difference between the current appraised value of your house and also the kept equilibrium in your mortgage.

- Such as for example, thought you bought property cherished in the $3 hundred,000. You made a deposit away from $60,000 and you will financed the others. Up to now, your very first house equity is $sixty,000-the amount you repaid initial.

Over time, because you remain to make mortgage payments, so it guarantee expands. For every percentage decreases the home loan equilibrium, and therefore increasing your possession stake regarding the property.

On the other hand, the house’s collateral can be develop as its market value appreciates. This could occurs because of standard housing market trends or courtesy developments and home improvements you will be making to your property.

- For-instance, if the, over the years, the market industry value of your house goes up proceed this site to help you $350,000 along with your financial balance are down to $220,000, your home collateral was $130,000 ($350,000 market price minus $220,000 home loan harmony).

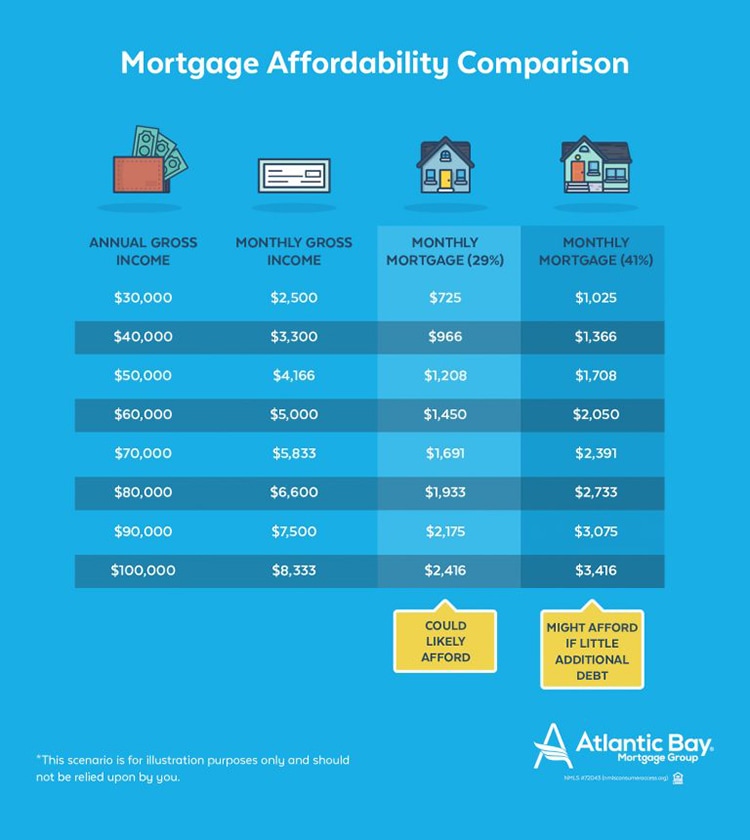

Expertise and you may strengthening household equity is vital, as possible give economic independency, allowing you to secure fund such home collateral contours off borrowing (HELOCs) otherwise home equity finance, which you can use for different purposes such as for example home improvements, merging loans, otherwise investment big expenditures such scientific expenses otherwise studies.

Do you really remove equity from your own home as opposed to refinancing?

Family collateral financing and House Collateral Credit lines (HELOCs) is actually preferred selection that permit you borrow secured on their residence’s equity while keeping their unique financial undamaged.

- Property security loan , often called an excellent next mortgage, enables you to borrow against the fresh new guarantee you manufactured in the assets, providing you with a lump sum payment of cash to make use of because the the thing is fit.

- HELOCs , while doing so, setting much like credit cards, where you could borrow cash as required doing a certain restriction. Each other selection routinely have straight down rates of interest as compared to other styles from money as they are protected by your home’s really worth.

Domestic collateral selection apart from refinancing become reverse mortgage loans, sale-leaseback preparations, and family equity investment. Consider, for every single alternatives features its own merits and you may potential drawbacks, making it crucial to carefully take a look at making an informed decision for your economic need and you may goals.

Ways to get security out of your home instead of refinancing

For folks who curently have a low, fixed-speed financial or if perhaps you may be well on the road to expenses off your financial, a money-away refi may well not add up. Instead, you can attempt a home equity line of credit (HELOC) or property security mortgage. This type of second mortgage loans let you bucks-out your home’s value instead refinancing your existing mortgage.

However, there are several almost every other decreased-known an effective way to tap family security instead refinancing. Some tips about what you must know.

1. House security line of credit (HELOC)

A house collateral line of credit, or HELOC, try a smart investment technique for people that don’t want to re-finance their primary home loan. It operates much like a credit card however, uses the home’s well worth once the cover, which allows all the way down interest rates.

No Comments