What’s Good Refinance And exactly how Will it Work?

When you buy property, your typically take-out a mortgage to invest in it, if you do not produced a nearly all-cash provide otherwise acquired the house through other products. If you find yourself in the process of paying down you to definitely home mortgage, you’ll encounter moments you may want to like to you could alter their terms and conditions. When you get separated, as an example, your e on the title. Interest levels might also get rid of, causing you to be waiting you had received your home loan on a reduced speed.

You can actually make this type of alter takes place through getting home financing refinance. Exactly what exactly is actually a beneficial re-finance, and how will it performs? Let’s fall apart just what an excellent re-finance try, how to get you to definitely and just how it could make it easier to.

What is Refinancing a mortgage?

An effective refinance try a procedure that enables you to alter your newest mortgage loan with a new you to definitely, generally one that has finest conditions. Your financial spends the loan to pay off the old you to definitely, so you is only going to have one commission to take worry each and every month.

Anybody typically refinance the mortgage loans for a number of factors. You can decrease your month-to-month mortgage repayments. Whenever you can safer mortgage lower than the main one you to begin with had your loan during the, you might like to have the ability to help save thousands of dollars in the focus across the life of the loan.

Beyond spending less, you might like to re-finance to eliminate problems. For people who got separated from someone which is however to your new term to your house, you can refinance to eradicate its identity. If you need to generate highest-scale home improvements to your residence, you can also re-finance to take money from your home equity to cover a property upgrade venture.

Simple tips to Refinance Home financing

Therefore, how will you go about refinancing a mortgage? If or not we want to refinance having a lesser price or bucks away specific guarantee, you will have to proceed with the exact same initial methods.

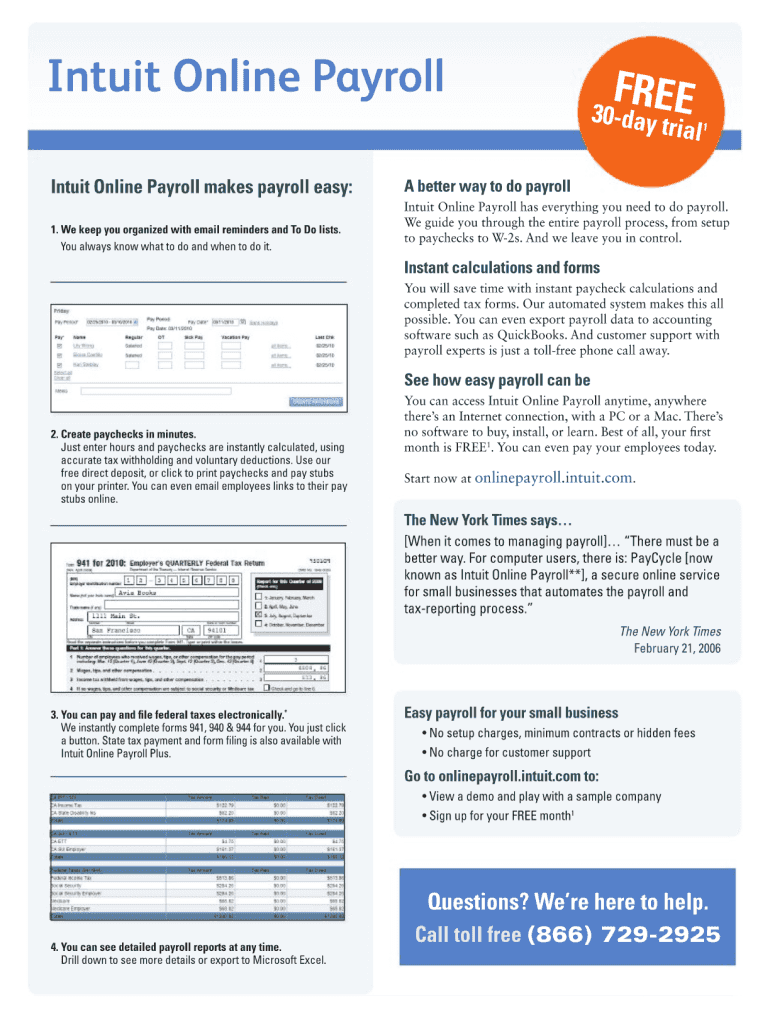

- Identical to delivering a loan to purchase a property, you will need to sign up for their refinance. Meaning you should ensure that your credit score was all the way to possible and that you pay down as often of your obligations as possible.

- Should you want to take https://paydayloancolorado.net/aristocrat-ranchettes/ cash out of your own current loan’s built-up house collateral, it’s also wise to make sure that beforehand you have enough to withdraw with the aim you will want it getting. We will discuss bucks-out refinances more detailed later on.

- Once you have had your borrowing, debt-to-earnings proportion (DTI) and other products in good shape, you ought to comparison shop having mortgage lenders. Get multiple rates of other lenders observe just what refinance rates has the benefit of are around for you. We want to make sure you get the rate and you may financing label and that’s most appropriate for your requirements refinancing to invest alot more for your home loan than simply you’re in advance of doesn’t generate far feel.

- In the long run, once you have settled with the promote you are preferred which have, it is possible to fill out an application. Brand new refinance application procedure is quite exactly like to acquire property: you can secure your interest rate, get an assessment and close towards the mortgage nearly a similar method since you performed initially.

Whenever In the event that you Refinance?

There’s no judge restriction exactly how many times you could refinance your house mortgage. For people who wished to, you might commercially refinance the half a year or probably even more often, depending on their lender’s standards. It is not possible that this strategy create help you far, in the event therefore would place a critical sink on your discounts so you can romantic on the that loan more often than once.

No Comments