Household Refinancing Ideas to Help you save Money and time: Information off a home Refinancing Team within the Danville, Illinois

Mortgage cost vary every day. Basically, healthier economic climates create high mortgage pricing and you can weaker economies make shorter mortgage pricing. People just who get belongings while in the enhanced rate of interest episodes will re-finance in the event that home loan costs shed.

Delivering a lower rate of interest compliment of family refinancing in the Danville, Illinois will save you too much currency. Check out things to consider:

Determine if Refinancing Is right for you

There’s some reasons why you might want to re-finance their mortgage. Choosing these records will allow you to make a very clear package off action. Eg, taking straight down monthly obligations, securing most readily useful rates of interest, settling loans faster, otherwise taking bucks-out re-finance tends to be reasons why we want to re-finance and you will replace your loan.

Check around to have a reputable Bank

Make sure to communicate with multiple house refinancing companies into the Danville and select the right one who’ll save you big date, opportunity, and you will costs. You do not have in order to refinance into bank who initially given your own mortgage. It’s important to research thoroughly and you will scout plenty of different lenders. Examine its costs and you may access, following finalize the offer you are most comfortable that have.

Have your Records Able

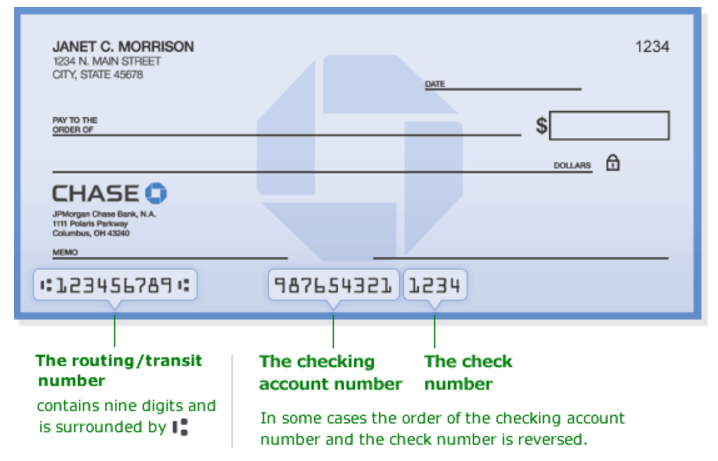

To facilitate the refinance process, have your software data files able, discuss on a regular basis together with your bank, and truly respond to their questions. On the other hand, collect your recent bank, tax, and spend slip statements. In addition to, whenever you are implementing along with your companion, give their paperwork also.

Double-check Your credit score to own Mistakes

If you’re looking to re-finance, double-examining credit file is going to be part of your financial routine. Credit file indicate your capability to repay loans, so if your credit score try lowest, domestic refinancing becomes way more difficult.

Therefore, when your statement is filled with problems, you’ll want to make sure they rating correctedmon credit report sneak-ups you can conflict is wrong information that is personal, money owed, copy remarks, or finalized of the financial membership number.

Improve your Credit rating

It’s your credit score you to definitely describes the new terms and conditions and you may speed of your house re-finance inside the Danville. As the a lower life expectancy credit rating can cost you more hours and you may money, it’s a good idea to work on the gathering the fresh rating. How do you do this?

Desired Closing costs

You will need to coverage particular settlement costs once you refinance your Danville household. A few of the popular expenses become:

- App percentage

- Lawyer fee

- Assessment fee

- Dismiss items

- Assessment commission

- Identity insurance rates

You could potentially fundamentally predict the costs to-be around 2 to 3% of overall amount borrowed. Yet not, you can become spending a great deal more (otherwise shorter) centered on the financial. It’s important to mention here that numerous some body always shell out closing costs upfront, because helps you to save currency.

Get ready for an appraisal

Extremely loan providers require that you features an assessment done when implementing having house refinancing into the Danville, Illinois. The idea should be to enhance the property’s well worth, that’s where are a handful of ways:

- Spruce up your place with fresher rooms and exteriors

- Build rewarding standing and make certain any renovation tasks are over before appraiser arrives

- Monitor all enhancements, and maintain the fresh just before-and-shortly after photos

Prepared to Talk with property Refinancing Company into the Danville https://elitecashadvance.com/loans/emergency-loans/, Illinois?

Making use of the above-said suggestions for domestic refinancing during the Danville, Illinois, you could develop get competitive rates of interest whenever you are preserving some time and currency. Are you ready to satisfy to your greatest-rated house refinancing providers when you look at the Danville, Illinois? If that’s the case, contact the pros during the Compass Mortgage at (877) 793-9362 to understand how we helps you generate an informed refinancing decision.

No Comments