Average HELOC Balance right up 2.7% into the 2023

The typical HELOC harmony rose so you’re able to $42,139 throughout the third quarter out of 2023, right up 2.7% regarding $41,045 mediocre a year prior.

In this post:

- Overall HELOC Balance Increased six.6% from inside the 2023

- What You’ll need for good HELOC (Along with Equity)

- HELOC Borrowing Limits Was upwards in 2023

- Younger People Likely to Be Scraping Household Collateral

- HELOC Stability Go up in most States

One thing that continues to work with account of many home owners ‘s payday loans Silver Cliff the collateral in their house. Home-based home has preferred by $15 trillion, to help you more than $58 trillion, once the 2020, according to the Government Set aside. At the same time, homeowners continuously paying its mortgages was in fact racking up security actually less compared to previous age.

Of numerous homeowners could use the win, since price of almost every other goods and services continues to vary and you will bigger-solution situations, such as for instance this new trucks, insurance costs and you may repair costs, was hiking almost as fast as home values.

Once the home prices raise, way more homeowners are leverage some of one to freshly won money in the the form of domestic equity lines of credit, or HELOCs. By credit some of the worth of a property, residents have the ability to make renovations or combine, pay down or pay-off highest-attract expense. Into the 2023, the average HELOC balance increased 2.7% in order to $42,139, and more than $20 million is put in the entire HELOC personal debt across the the You.S. people.

Included in our persisted exposure of credit and loans, we checked-out anonymized Experian borrowing analysis to see latest manner home financing market, and HELOCs.

Complete HELOC Balance Enhanced 6.6% from inside the 2023

It was not always similar to this, yet not. Just how homeowners have remaining about scraping their house guarantee possess changed throughout the 2010s, when mortgage refinancing costs bumped across the 3% in order to cuatro% Annual percentage rate diversity. In those days, the brand new go-to move would be to refinance a preexisting home loan which have a bigger financing (have a tendency to which have a lower life expectancy Annual percentage rate) and money out any extra fund, which also get money straight back throughout that shiny the fresh new mortgage.

On the 2010s, interest in HELOCs waned just like the banks well-known giving more successful mortgage refinances to home owners. Refinancing became a win-earn problem getting finance companies and their people: Banking companies authored a number of the newest percentage-producing mortgages, and you can homeowners got possibly a minimal-focus loan through a finances-away refinance, a diminished monthly payment otherwise, occasionally, one another.

But with financial prices today swinging ranging from six% in order to eight% in place of step 3% so you’re able to cuatro%, you to mathematics no further functions. As an alternative, more people are utilizing HELOCs in order to power their residence equity.

The fresh restored interest in HELOCs now’s apparent, that have individual interest in refinancing a mortgage mostly disappearing due to the fact pair property owners which have mortgage loans have the ability to refinance at lower prices. To help you borrow secured on present security rather than refinancing, home owners need to trust either house equity financing or HELOCs.

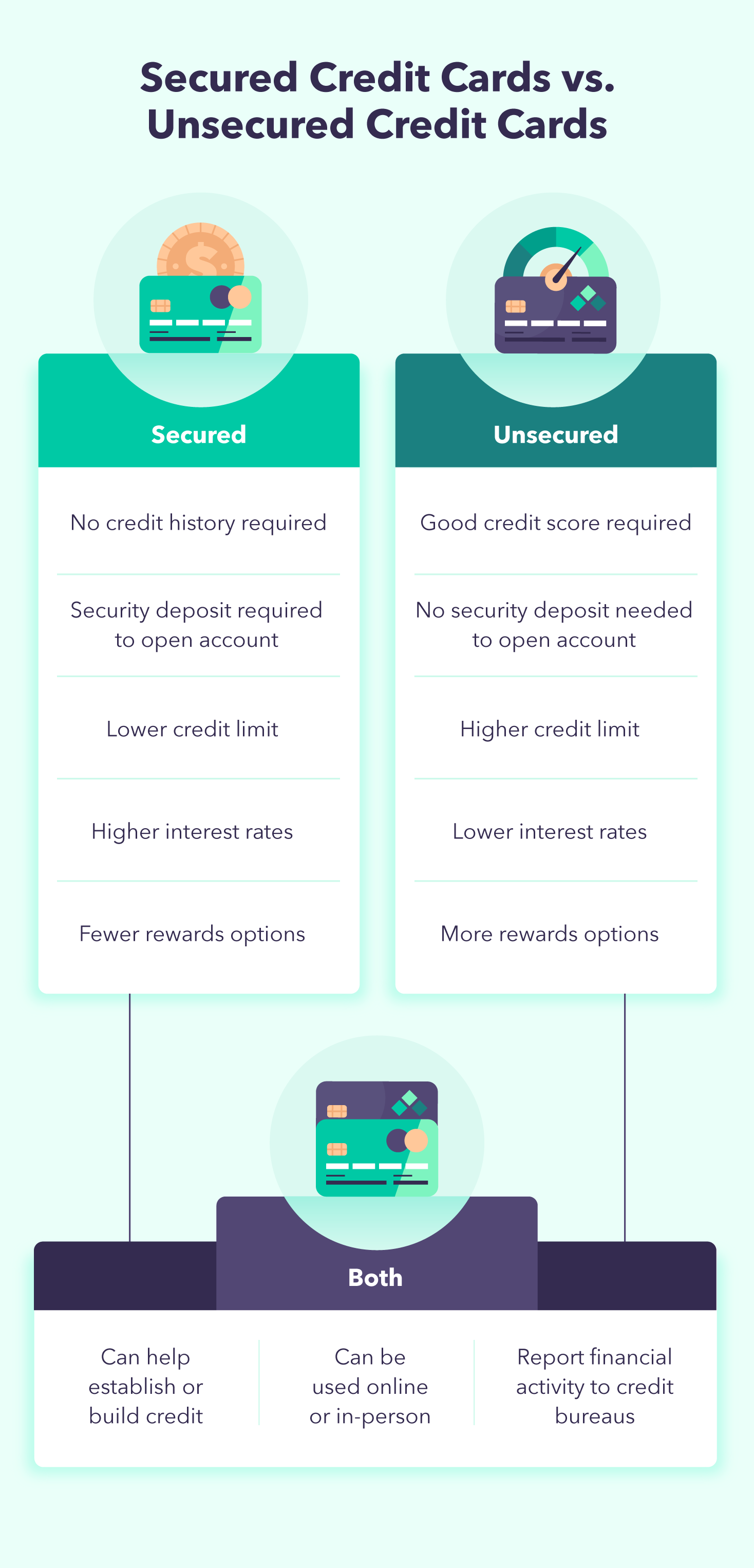

Household collateral finance is the lump-sum service: Property owners use a specific amount in the a predetermined interest rate and you can pay-off the mortgage just like a cost loan. HELOCs offer a line of credit which is there when you need it, and can feel paid more than quite a while.

Just what Necessary for a great HELOC (Besides Guarantee)

A great HELOC try a personal line of credit protected by the collateral a citizen has within the a house. HELOC lenders allow homeowners to help you faucet doing a certain percentage of paid-away from portion of its mortgage. Such as, anyone who has a property valued on $400,000 with $100,000 left on the home loan could probably tap upwards to 80% of that collateral-$240,000-in the way of an effective HELOC.

No Comments