Friend Financial Car finance Comment having 2022

If you’re looking for an auto loan which have independency and easy installment choice, you need to imagine a loan courtesy Friend Bank. These car and truck loans is versatile, level obtainable automobile and you will industrial vehicles that many most other lenders end. And additionally, which have four other payment methods and you can a free application to aid you manage your mortgage, Friend Financial automotive loans manufactured along with your benefits in mind.

Ally Lender even offers multiple characteristics, as well as playing cards, home loans, and you may auto investment. In reality, Friend Bank, a part off Ally Financial, provides automotive loans once the 1919. Ally serves more than 18,100 dealerships and you may four mil people throughout the Us.

Car and truck loans as a consequence of Ally include several advantages, including the substitute for promote back your car or truck toward lender and you will a good balloon fee option for lower monthly installments. But not, you can simply get such finance by purchasing off a dealership one people which have Ally, thus whenever you are there is some restrict, these funds can still feel a great fit for you.

Friend Bank Auto loan Facts

Ally now offers the brand new and you may car or truck funds that are bought at the fresh new supplier. Although not, they don’t offer loans to own RVs, motorcycles, otherwise powersport vehicle.

Loan terms and conditions are 12-84 weeks and mortgage amounts include $step 1,000 to $3 hundred,100000. There’s absolutely no minimum credit history. Yet not, extremely borrowers has fico scores off 620 or even more. In prequalification procedure, a delicate borrowing inquiry is did, this would not affect your credit history.

Ally Financial Auto loan Application Requirements

You’ll want to sign up for an ally auto loan from dealer in which you are buying your car. In order to streamline the process, make certain you have got all the standard data and you will information one automobile financing want:

- Private information, just like your mailing target, email, and you will Personal Safeguards matter

- Income pointers, including your annual gross income and make contact with suggestions to suit your newest company

The new provider will also need certainly to also provide information regarding the car you may be purchasing, but you is always to determine how much you will need to money and you will what monthly obligations you really can afford.

While you are merely carrying out the automobile searching techniques and you can haven’t discover a car we need to pick, Ally’s month-to-month car payment calculator will help. So it calculator enables you to change the finance matter, Annual percentage rate, and you may mortgage title observe what your monthly premiums will be as with different items. It will help to provide a sense of how big and kind of car loan squeeze into your monthly funds. After that, you might attention your vehicle browse automobiles to pay for.

Kind of Auto loans Available Compliment of Friend Financial

- New- and you can made use of-car loans to possess car bought through a car dealership

- Book possibilities having reduced financial support conditions

- Specialty-vehicles funding having vehicles which have accessibility enjoys particularly wheelchair lifts

- Business vehicle funding, including heavy-obligation truck investment

If you are looking to shop for an automobile, Friend Vehicles Financing also offers fund for new, made use of, and you will official pre-possessed automobiles. Automobile must have 120,one hundred thousand miles or smaller and become as much as 10 years dated.

Steps to make Your repayments

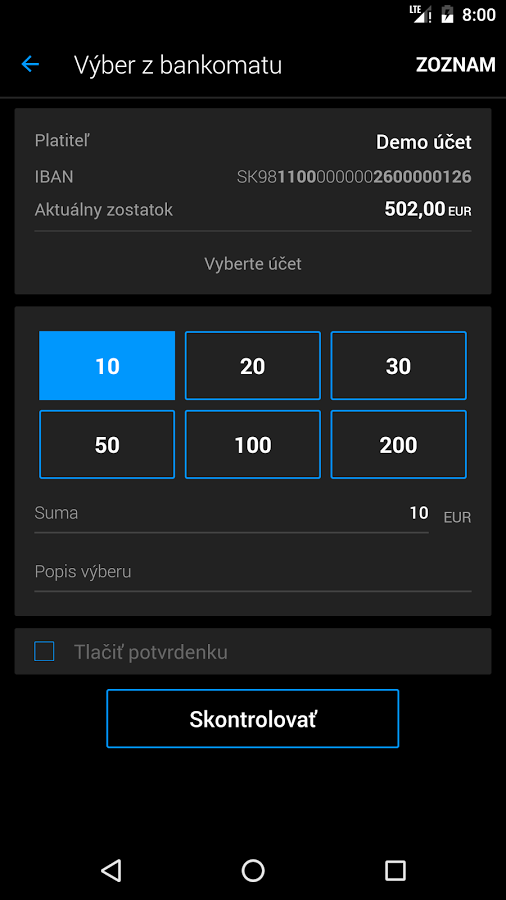

- Explore Friend Car Mobile Shell out, designed for new iphone 4 and you can Android os, in order to schedule repayments.

- Put up one-time otherwise automatic recurring payments on the internet.

- Send a fees by have a look at in order to Ally’s handling cardiovascular system.

Charge and you can Pricing

Friend Financial merely offers money thanks to dealerships, so you’ll need to incorporate owing to a dealership locate pointers to the rates. Ally Economic also provides aggressive mortgage prices, however, remember that your credit rating in addition to count of cash you devote off tend to affect their rates and monthly payments.

Should you want to pay down the loan early, Friend will not take on dominant-simply money. It means they don’t explore any additional currency you pay for the your car mortgage to carry down the principal equilibrium. Alternatively, these types of funds goes with the charge or financing charge.

After you shell out those costs completely, they are going to apply the additional currency for the your following mortgage costs. Such fees approach is also sluggish you down while you are looking to pay off the loan rapidly because your extra costs commonly heading straight to your debts.

Friend Bank Car finance Software Process

You simply cannot submit an application for that loan personally with Friend Vehicles Financing. As an alternative, make an effort to affect a dealership the lender people having. When you pertain from the provider, you’re going to get factual statements about rates of interest and loan terms.

A dealership makes it possible to supply several kinds of automobile financing, each other by way of Friend or other organization. This can be top whilst enables you to quickly contrast attract pricing and you can financing conditions to find the best mortgage for the needs.

Friend Financial Car finance Special features

Ally Car Finance possess financing system called the Friend Balloon Virtue. This type of finance come with a number of novel have which make them appealing alternatives. Here is what you can expect:

Friend Financial now offers a buyer’s Alternatives system, which might be greatest for many who welcome attempting to sell their car in a few many years. To the system, you have a choice of selling your car or truck so you can Friend sometimes forty eight or sixty weeks into the financing term.

You might want to keep the vehicles and you will carry on with their loan repayments, or you can promote the car without the troubles of coping that have a private profit. This method is available in every states except Las vegas.

Realization

There are lots of downsides so you can Friend Bank auto loans, such as the proven fact that you can’t generate prominent-merely costs and require to use as a result of a dealership. not, if you plan into the finishing a funds software courtesy a car dealership in any event, you might find one to Ally Financial automotive loans come with aggressive rates. Concurrently, with advantages such as the Consumer’s Choices program as well as the Friend Balloon Advantage alternative, a https://cashadvanceamerica.net/loans/small-payday-loans/ friend Lender auto loan could end right up being the most useful one for you.

No Comments