Individuals deal with early-payment costs into 50 % of all the unsecured loans

Settling that loan earlier than asked is elevator an enormous lbs from your own shoulders – but the majority of business usually struck you having a hefty percentage for clearing the debt before the concurred timeframe.

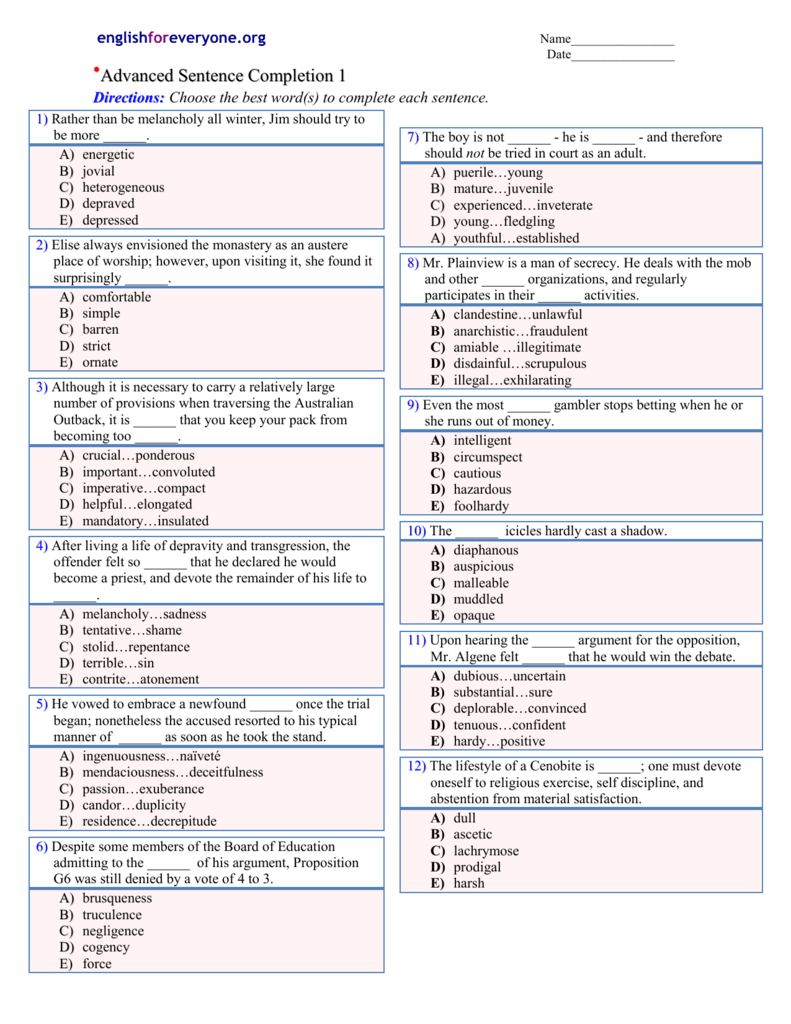

Which? investigation keeps unearthed that 59% out of personal loans on the market today come with very early-payment costs (ERCs), a charge applied for many who repay your financial situation till the end of one’s deal.

We inform you the borrowed funds business hitting people with this particular charge and where to find a loan in place of ERCs if you need brand new solution to pay-off your debt in the course of time penalty-free.

That it newsletter brings free currency-relevant blogs, together with other facts about Which? Classification services. Unsubscribe whenever you want. Your computer installment long term loans no credit check Windsor FL data could be processed according to all of our Online privacy policy

You could expect to track down ERCs into the enough time-label products like mortgage loans nonetheless they along with connect with many away from unsecured signature loans .

Of the 73 personal loan things on the age which have very early payment charge, our studies of Moneyfacts analysis found – definition just 29 loan issues do not charge you to own early fees.

A total of twenty eight additional team costs ERCs on the mortgage issues. Thank goodness we receive 20 team one to provided versatile financing no very early-percentage charges.

- When you have below one year kept on your bundle, providers can charge to twenty eight days’ attract.

- When you yourself have over annually to go,organization can add on an extra 1 month or that thirty day period.

Therefore, according to the coverage of your organization you take the borrowed funds having,you are charged very same to 1 or a couple month’s desire.

The reason being focus accounts for a more impressive portion of the financing payment in early amounts of your bargain. If you try to clear your debt close to the beginning of the their contract, your own bill might possibly be a bit large, no matter if this may nevertheless never be to the appeal you’d need to pay by the sticking with the latest installment package.

Ideal personal loans versus ERCs

When you compare loans, make sure to take a closer look at terms and you will conditions of unit just before bouncing in.

If there is a go that you’re able to pay back your loan before the prevent of their identity, then chances are you must look into a flexible loan.

- Get the full story:a knowledgeable unsecured loan selling – the best rates in the business plus the important information evaluate product sales including if a product keeps early cost fees.

So why do very early installment fees pertain?

With the a great ?ten,000 loan taken out more than five years during the 2.9%, a loan provider carry out expect to make ? within the desire – many from the could be destroyed when your loan are cleared very early.

Very early cost charges make up loan providers for this losses. On flipside, the newest charges disincentivise people from clearing bills as soon as possible and you can remaining their interest minimal.

How-to pay off your mortgage very early

If you want to pay-off your loan early, you really need to speak to your bank to demand an enthusiastic ‘early payment amount’ with the financing.

The financial will provide you with a statistic that may otherwise will most likely not include ERCs based its rules and give you a time period of 28 weeks to invest they.

You will not getting less than any obligation to blow in the event the fees are too higher and will carry on with the mortgage just like the arranged.

For people who just want to generate an enthusiastic overpayment, you need to once more notify your financial. If the ERCs apply to overpayments, the financial institution could possibly get give you information on brand new charge and give your 28 weeks to pay.

This may either help you reduce your lingering costs across the exact same identity or slow down the identity of the mortgage, according to the lender’s coverage.

No Comments