FHA versus Old-fashioned Money: Which is Healthier?

There are programs and pathways of having towards the home buying markets. To have first-big date homebuyers particularly, 2 kinds of reasonable down-payment finance is FHA and you may Traditional finance. Your Financial at the EPM can help you take a much deeper search and decide hence financial is right for you. But we also want to take some popular issues and you will place out of the benefits and drawbacks of both sorts of mortgages, for finding a start towards expertise precisely what the credit conditions is actually, and which kind of mortgage might fit your demands ideal.

What’s the Difference between FHA and you will Antique Funds?

FHA is short for Federal Houses Management. And FHA financing try supported by government entities. The fresh FHA means such mortgage brokers and generally are available using FHA-approved loan providers throughout the All of us. This can be an excellent place to start to possess basic-day homeowners who don’t provides a large down-payment available otherwise may have a lower credit score.

Antique Home commercial loan refinance personal guarantee loans try started and you will maintained by the individual mortgage lenders, banking companies, and you may borrowing unions. Of numerous loan providers whom render antique money might give government-insured funds. When you have a healthier credit rating otherwise has actually stored a 20% advance payment before making an application for your loan, you could be eligible for a traditional loan.

How much does a deposit on the a great FHA compared to Old-fashioned Financing Look Such as for instance?

Fundamentally might spend good 3.5% deposit towards the an enthusiastic FHA loan. If you have a lower credit score otherwise debt so you can income-proportion, that may increase to 10%

Traditional funds need a great 20% deposit. If you don’t have 20% to get off, you must get PMI ( Private mortgage insurance rates) and premiums could indicate you wind up purchasing so much more when you look at the the future. See our prior article on PMI to find out more

What Should i Discover My Credit rating and you will Mortgage loans?

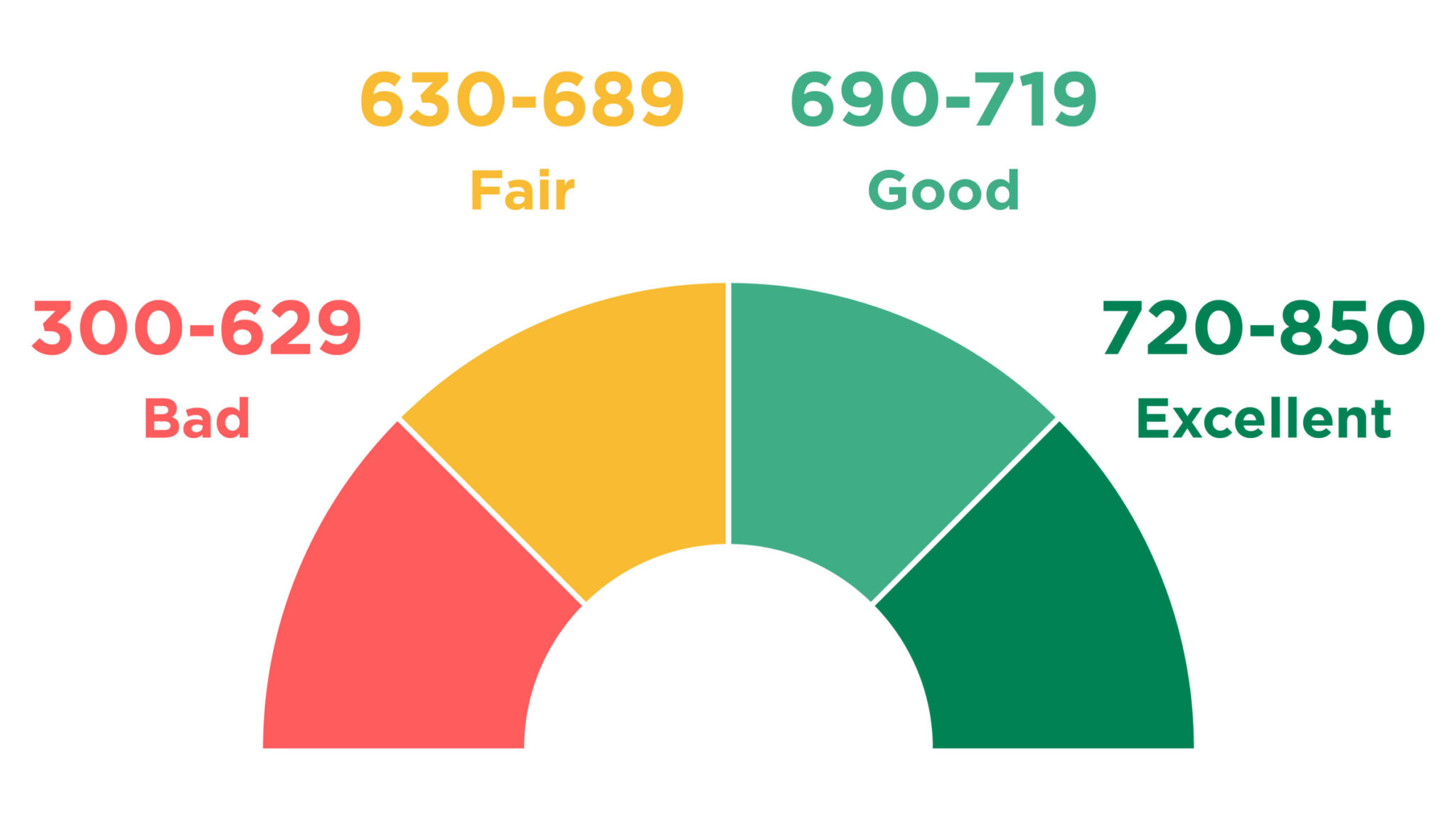

With a keen FHA Mortgage, your own FICO get can be on the low 500s, however, loan providers may need one build one up higher earliest just before they’re going to approve your loan. In addition may have to remember some whatever else away from credit score alone, eg fee background and debt-to-money proportion. For those who have got a bankruptcy proceeding in earlier times, an FHA financing could well be convenient online than simply good antique financing. The reduced your credit score, the higher the new asked downpayment will be.

That have Old-fashioned Financing, need the very least credit history out-of 620, however, once again, just like the pandemic, many loan providers need to force men and women criteria upwards. A higher credit rating will also help reduce your rates of interest.

How about Mortgage Insurance towards the an FHA or Conventional Mortgage?

FHA Financing are insured by Government Property Authority plus up-side financial premiums is step one.75% of financing. New FHA becomes these premiums upon the newest closing of your property, but you’ll get it placed into all round cost of their home loan and you can spend with it from inside the lifetime of your mortgage. You’ll also spend the money for FHA a yearly Personal Financial premium that your particular lender will help you assess in line with the duration of the mortgage, the total amount you devote down, as well as the property value your home.

Conventional fund promote PMI ( Individual Financial Insurance) and you may pay the premium for at least sixty months with the a thirty-year home loan. If you have an effective fifteen-12 months mortgage- once you have paid roughly twenty two% of the worth of your loan, the borrowed funds payments normally avoid.

Now that you’ve got a summary as they are armed with certain suggestions to find the golf ball moving, the newest leading lenders from the EPM would love to support you in finding away exactly what loan is the best for individual means. We have been right here to respond to the questions you have, and also have you already been on the road to homeownership with full confidence.

No Comments