Affirm possess a slightly more model than just Brigit and also the almost every other pay day loan applications you are regularly

not, immediately following using it for some time, you’ll be able to understand that its good equipment getting staff also since they shares lots of similarities with Brigit.

Your develop a pay balance from the completing shifts and, once you have strike the minimum matter, you might withdraw the amount of money quickly, as soon as your own income comes in, you aren’t looking forward to weeks or months to truly get your hands on the cash. The advance you’ve got acquired would-be deducted.

DailyPay charges a small fee away from $1.twenty-five, the cost of sending the advance from the DailyPay membership with the checking account. Except that this transfer payment, there aren’t any other charge involved, so users don’t get billed monthly costs eg Brigit.

Using this app, this new insecurities that employees has actually about their earnings try considerably quicker, and therefore are able to alive the life as opposed to stress.

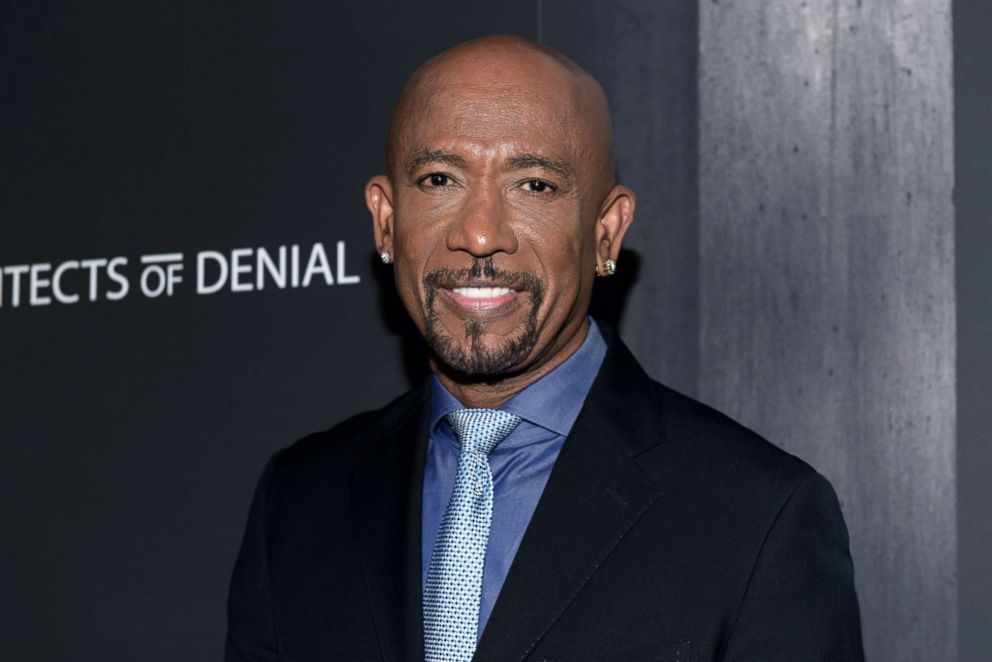

9. Affirm

Rather than providing a lump sum of cash upfront, they provide you with financing for your get. This might be an excellent option if you’re looking to finance a huge pick.

New application features other elements which make it a formidable opponent so you can Brigit eg have to help you control your expenses effectively, and additionally build safer transactions.

Together with monitoring their searching expenses, Affirm offers you the capability to pick deals and you can vouchers into stores you love, which can help save you a lot of money about much time work with.

The latest application work online so you need-not install almost anything to utilize it. Merely register and also have been.

ten. Encourage

Instance Brigit, Encourage is happy to provide your up to $250. not, in the place of the former, Empower doesn’t include month-to-month costs. Instead, this has an apr away from 0.25% and you may a loans handle charge away from $8.

With Encourage, there’s absolutely no credit check. Rather, the latest application assesses their paying activities to supply a funds get better.

Nonetheless they do not costs having late costs, but if you standard in your mortgage, you will be hurting your odds of getting the means to access various other one once you may need they.

So you can be eligible for the new $250 advance, you ought to perform a healthier make up at the very least two months while having at the least $five-hundred as your month-to-month money.

Empower also features other properties particularly interest-totally free checking, helping you to automate their discounts, record your costs, and more.

Its rescuing feature is known as Enable AutoSave Membership and is also a mutual membership that have Encourage. It functions naturally and can help you stay prior to their cash.

The latest software also helps you have made bucks-straight back from the a few of your preferred places, to help you help save significantly more money.

eleven. Varo

Varo try https://elitecashadvance.com/loans/personal-loans-for-good-credit/ a complicated financial management app that offers a profit improve element. The app boasts of one or more mil pages and has a premier rating certainly users of the unique has they has the benefit of.

As much as the bucks get better feature can be involved, Varo now offers a line of credit as opposed to costs as much as $fifty. There is zero transfer payment, overseas deal payment, or yearly payment. You can access money owing to an automatic teller machine, otherwise lead put to your membership.

Varo now offers personal loans as high as $25,one hundred thousand payable in this three to five many years. That it boasts a reduced Apr of between 6.9%-23.9%.

In place of Brigit, Varo performs borrowing from the bank monitors, but and also this means that you can make use of brand new app to help you change your credit rating.

No Comments