If you’re thinking-operating and seeking to be eligible for home financing when you look at the Fl, we’d always work with you

Standard Standards having Mind-Employed Finance

- Credit score. Conventional fund have stricter credit rating requirements than simply regulators-backed financing (ex: FHA money), and personal fund are not credit rating passionate.

- Credit score. Much like the a few-year rule regarding your money, additionally need to establish at the least 2 yrs away from borrowing from the bank history with toward-time money. Individual financing do not require a certain period of borrowing from the bank; although not, delinquencies (ex: foreclosure) will require then reason.

- Most recent expenses and you will debt-to-earnings proportion (DTI). No income documentation is required to have personal funds due to Vaster because the we don’t need to ensure they in this instance. You’ll need to offer a couple of years’ worthy of to have verification for all almost every other financing products, as well as your DTI ought not to surpass 50 percent.

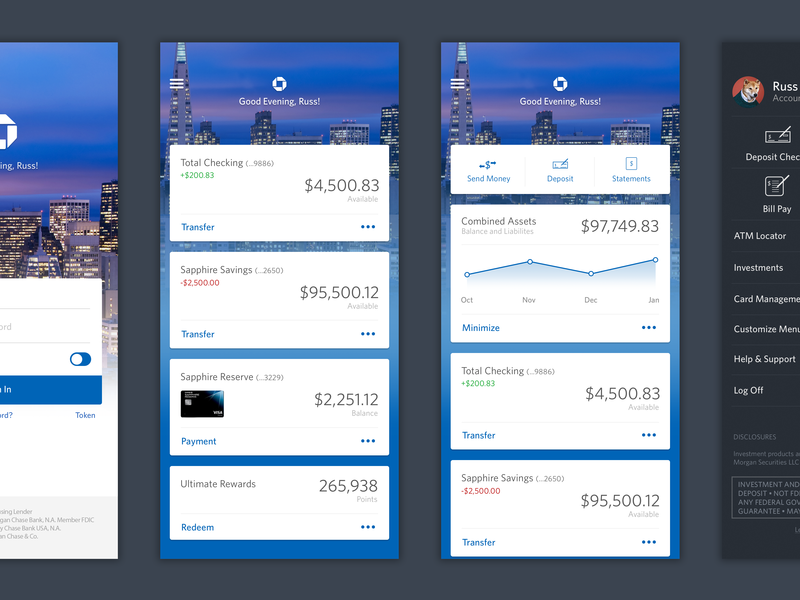

- Water deals and assets. You will have to promote a duplicate of one’s financial comments to possess personal funds. Your finances need certainly to show that you’ve got enough exchangeability to protection half dozen months’ worth of appeal costs. Liquidity ‘s the sum of money and you can property readily available to help you pay bills to the short notice.

Really mortgage lenders requires one fulfill specific otherwise all the of the significantly more than standards so you’re able to be eligible for home financing. You should keep very detail by detail info due to the fact a self-operating person; you will need to develop various sorts of documents inside the real estate techniques.

Self-Functioning Earnings Files

You will find several methods show income since a personal-employed individual. If you do package works, your employer might provide you with good 1099 setting from the the termination of this new taxation 12 months. Check out alternative methods to prove your revenue.

- Personal bank statements

- Money/losses declaration

- 24 months worth of tax returns (including your company tax statements)

- Shell out stubs (for people who pay oneself like that)

Before you can submit your home loan app, ensure easy access to all of your current essential records; the lender tend to ask for them instantly.

Are you presently Self-Operating?

Unclear for individuals who be considered just like the a self-operating individual? Youre experienced self-employed for many who individual 25 % (minimum) out-of a corporate, was a beneficial freelancer, or become an independent specialist and discovered an clickcashadvance.com/personal-loans-nj/new-brunswick/ excellent 1099 taxation setting.

Types of Worry about-Employment

- Entrepreneur

Such sphere away from functions (and many others) is actually sought out by freelancers since they are from inside the popular and just have highest-income possible.

Self-Working Earnings Calculation

Out-of income, mortgage enterprises usually have even more difficulties crunching the fresh new quantity to possess freelancers otherwise separate builders. In order to assess the fresh payment for self-working individuals, mortgage lenders must refer to files particularly 1099’s or earnings/loss comments. Speaking of reduced quick than just a routine pay stub or W-2.

If you are worry about-employed, loan providers look at the net gain, not your revenues, eg they will should you have an effective W-dos reputation. If you’d like to estimate their net income for your home loan application, realize these basic steps.

Once you understand your own net income offers some thought of just what to anticipate regarding a mortgage team; yet not, the financial institution tend to still need to verify your income to their own.

Score a home-Employed Mortgage Having Vaster

There’s no a lot of time and you can removed-away buy techniques. Our very own competent mortgage specialists help domestic hunters romantic to your functions quickly; the way it would be.

Whether you’re a good freelancer otherwise operator, we possess the best home loan provider for each and every version of visitors. Reach out to united states; we are going to enable you to get into your dream domestic.

To be eligible for financing given that a home-operating people, you will need to meet certain criteria very first. Given that highlighted above, all the financing type has its requirements, however, this is basically the comprehensive record really lenders search from an effective borrower.

No Comments