How come A student-based loan Apply at Home financing Pre-Acceptance?

Big date Wrote:

Very first home buyers are anxiety about the dimensions of its Student loan as well as how it does apply to their likelihood of bringing a mortgage. But exactly how much does it really matter?

Financial Lab’s objective is usually to be the fresh new digital town square to possess monetary choice-brands to gain knowledge about the newest and you can future home loan. Realize all of us on Facebook and you may LinkedIn or join our very own newsletter are informed of our newest posts.

Very, you examined hard for many years and you can, to find indeed there, you obtained a student loan. For the courses, for your courses, as well as some money to live on. Now you payday loans in Lakeland Village have a deposit getting a property and you can students Financing of 4 times you to definitely! How do you share with the lending company their Student loan goes to take you longer than your financial to repay?

Which are the dos Hurdles of getting a mortgage?

For those who read all of our posts have a tendency to, you will certainly know that someone usually face one of two hurdles whenever bringing home financing.

- in initial deposit Hurdle (you don’t need to enough deposit) otherwise,

- a living Hurdle (you don’t have adequate earnings to cover all of the costs).

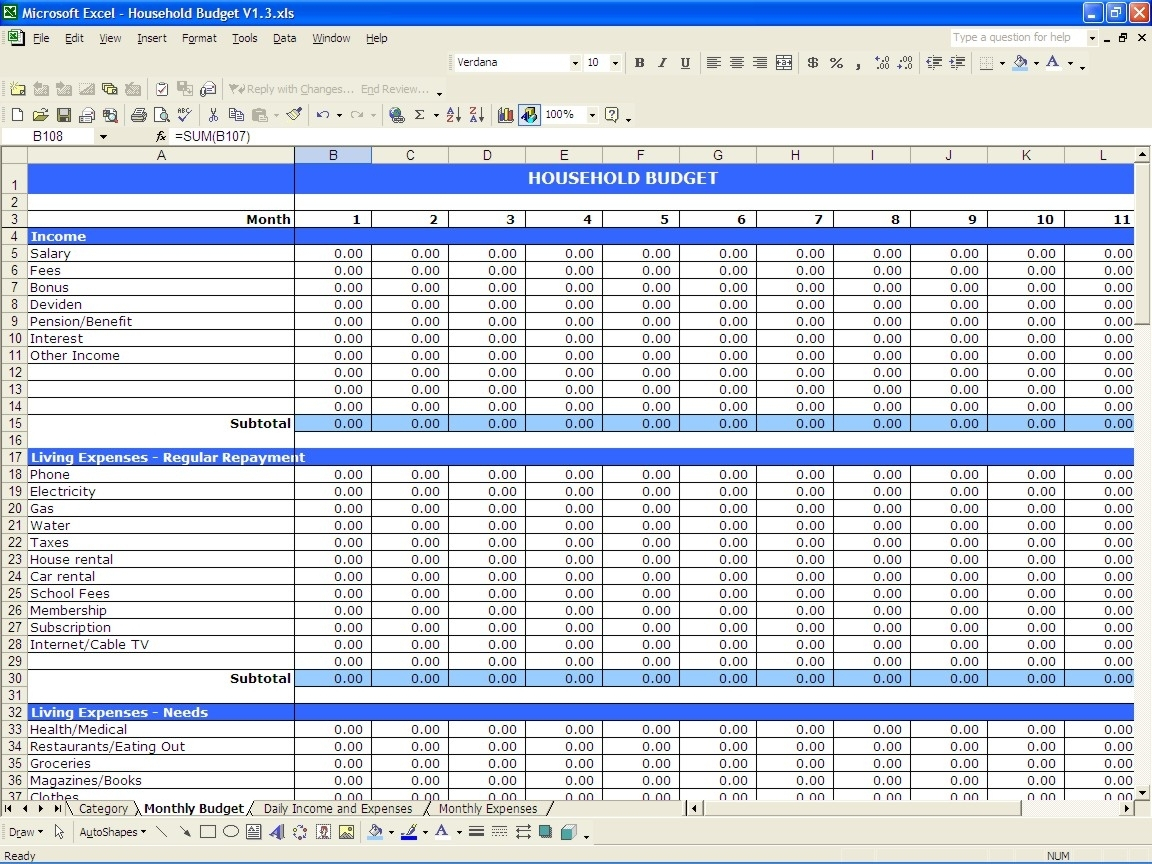

Student loans decrease your earnings (the federal government removes twelve% of your own paycheck after you earn much more than simply $19,084 per year). Financial institutions get one number of your revenue when they are figuring how much you can afford. Generally, a student loan helps it be and that means you strike the Money Hurdle prior to.

Precisely what does my Student loan apply to my financial pre-recognition?

This is actually the most important question to know concerning bank’s calculation. It actually does not matter simply how much you owe on the Scholar Loan; the bank will reduce the useable income it doesn’t matter.

This will be very good news for everyone which have eyes-watering Money. The formula is the same whether your $step 3,000 or $three hundred,100000 remaining. The financial institution only will not worry. They might care should you have a great $three hundred,000 Mastercard (obviously) yet not a student loan. As to the reasons? Because your costs are nevertheless 12% of one’s income with no a great deal more. Government entities are unable to name the loan from inside the therefore the repayments is generated immediately. It is even attention-100 % free, so long as you stay static in the country. It is as close so you can an effective obligations as you can score.

Keep in mind that these types of computations and you will laws are not unique to help you The new Zealand otherwise NZ Banking institutions. They are a normal practice to another country too.

Ought i pay back my Education loan in case it is only small?

When you find yourself hitting the Income Difficulty (you really have adequate deposit your money are stopping you moving forward) and only possess a little Education loan leftover, think paying you to Student loan. Yes, you happen to be settling a destination 100 % free mortgage hence isn’t ideal, but you’ll score a good 12% money raise which could get you what you want.

So let’s say your entire savings total up to good ten% put and you are thinking of buying a home. You did not use any kind of that cash to expend down their Student loan because you manage then have less than ten% put rendering it progressively tough.

In the event the, yet not, you had a beneficial several% put and you may failed to obtain to you desired because your Student loan is restricting simply how much earnings you had, you could use both% of your deposit to remove the Education loan. This will nevertheless leave you having a ten% deposit plus earnings to place to your financial!

Should i save to have a home deposit otherwise create extra payments with the my Student loan?

The answer to which the same as whether you should spend it off completely. Student education loans are not necessarily a detrimental situation when you have an abundance of money to pay for a mortgage. The primary real question is, have you got sufficient deposit to purchase a home? Otherwise, plus mission is to purchase a house soon, next i strongly recommend next methods:

No Comments